2021 European Hotel Transactions | By Shaffer Patrick and Matthias Hecht

2021 was a year of strong recovery for European hotel transactions. A total of €16.4 billion [1] worth of hotels changed hands, representing 322 individual transactions, 498 hotels and 79,000 rooms. Hotel prices per room were generally more expensive than in both 2020 and 2019, led by significant price increases in single-asset transactions, particularly in the Nordics. Portfolios that traded tended to have more hotels and more rooms per hotel than in 2020, indicating increasing investor confidence. The most active investors were largely European, followed by North American investors. Asian investors were significantly more active than in 2020, while Middle Eastern investors were noticeably less active. Virtually all investor types were active buyers in 2021. Hotel Operators disposed of the most hotels. Overall, Institutional Investors and Private Equity Investors were the largest net buyers. While total volume in 2021 doubled that of 2020, it fell nearly 40% short of 2019 levels on account of significantly fewer portfolio transactions.

Single Assets

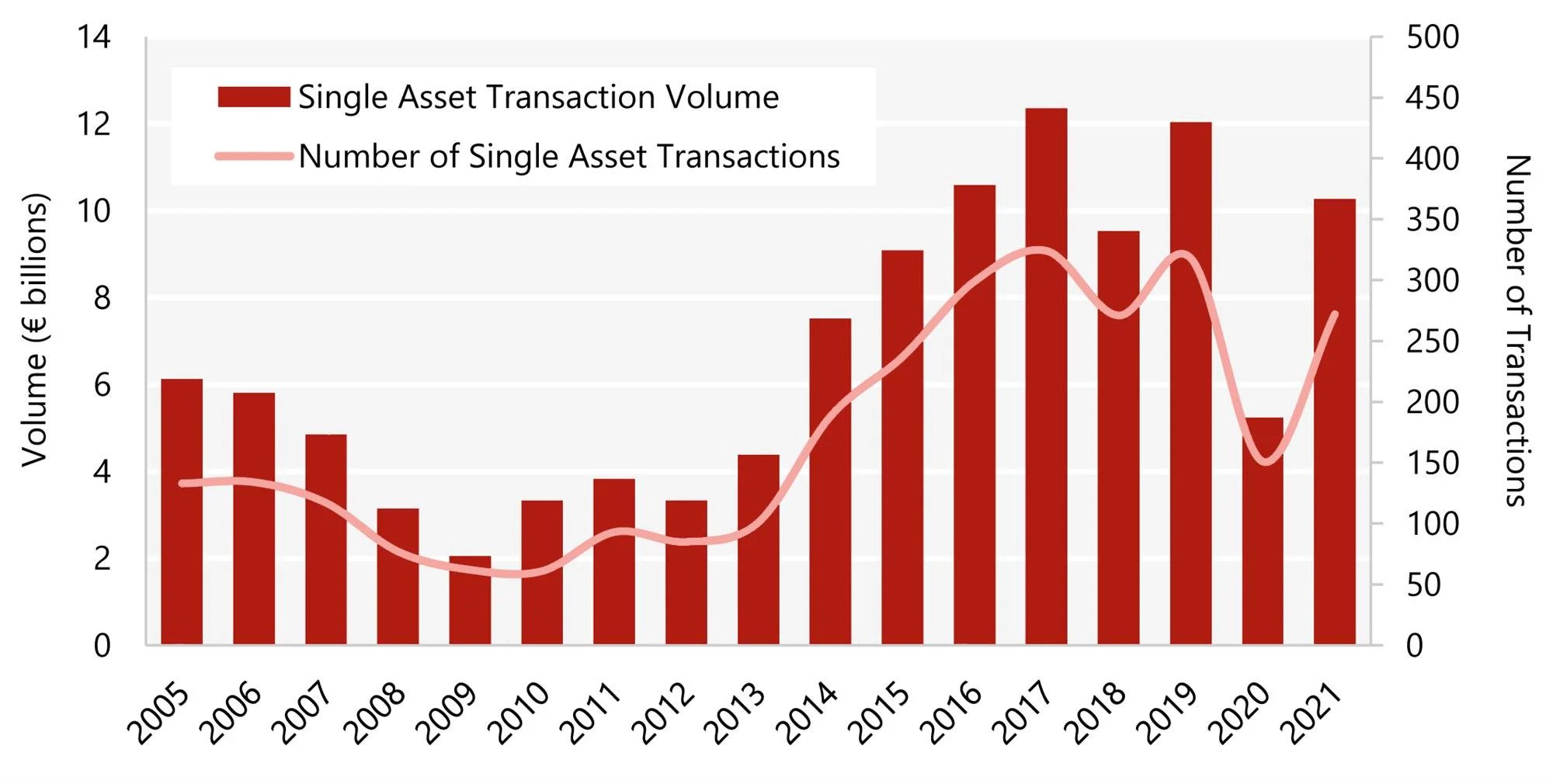

Single-asset volumes were highly resilient in 2021, doubling the 2020 volume and falling just shy of 2019 levels, as shown in Chart 1. Key drivers of volume were the UK and Spain, which collectively accounted for half of all single-asset transactions.

Chart 1: Single Asset Investment Volume 2005-21

Hotels in 2021, when sold singly, were more expensive, reaching the highest average price per room ever recorded, driven by COVID-aid-related inflation and the sheer weight of dry powder in the market, as cash-flush investors bid for opportunities. Price increases were led by the Nordics, with triple-digit increases in average price per room sold in Norway, Sweden and Denmark. Transaction activity generally spiked in periods of reduced COVID restrictions, with the top times for deals being peak summer and December. While European investors dominated the single-asset transaction market, with involvement in three-quarters of transactions, the rest-of-the-world capital stack shifted. Asian investors were involved in eight times more transactions than last year. Meanwhile, Middle Eastern investors were largely inactive, a staunch contrast to 2020’s headline display of capital on the acquisition of the Ritz London. Overall, 2021 single-asset markets demonstrated significant resilience, highlighting the continued strength of the European hotel market.

Volume

- Single-asset investment volume in Europe doubled to €10.3 billion in 2021;

- 2021 single-asset transaction volumes increased 96% compared to 2020 and fell only 15% shy of 2019, pre-pandemic levels;

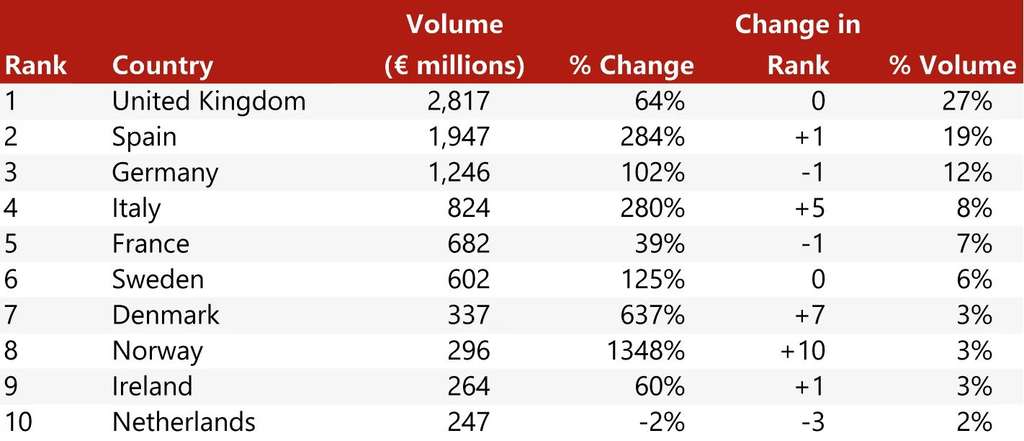

- As can be seen in Chart 2, volume was led by the UK (€2.8 billion) and Spain (€1.9 billion), which collectively accounted for half of all single-asset transactions.

Chart 2: Single Asset Transaction Volumes by Country 2021

Pricing & Deal Size

- Single-asset hotel prices reached €260,000 per room on average, the highest level ever recorded. Compared to 2020, the average price per room was €35,000 (+16%) higher in 2021. Compared to 2019, the average price per room was €42,000 (+19%) more expensive;

- Single-asset hotels transacted for €37 million on average in 2021, an increase of 9% and €3 million more than in 2020;

- Nordic countries were at the epicentre of price increases, with an average price-per-room increase of 70% compared to 2020. Leading the region were Norway, Sweden and Denmark, which saw average price-per-room increases of more than 200%;

- Other markets with significant price increases per room include Croatia (+288%), Belgium (+101%), Germany (+76%), Spain (+32%) and France (+19%).

The Madrid EDITION

Capital by Continent

- 72% of single-asset acquisitions were undertaken by European investors, followed by 14% from North America and 7% from Asia;

- Asian investors were significantly more active in 2021 than in 2020, with €712 million in acquisitions and €425 million in disposals, which was largely driven by a single transaction, the Holiday Inn Forum Kensington, in London, bought for £355 million by Fragrance Group (41.3% of the Asian acquisition volume). Asian investors had been virtually inactive in 2020, with only €100 million in total single-asset activity for the year;

- Middle Eastern buyers were notably absent from 2021, with only €50 million in single-asset activity for the year;

- North American companies were net buyers for the year with €650 million more in acquisitions than disposals, while Europeans were net sellers, with €275 million more in disposals.

Notable Transactions

Presented in Chart 3 are a selection of single-asset transactions that occurred over the course of 2021. To access the full list of transactions, please contact [email protected].

Chart 3: Notable Single-Asset European Transactions in 2021

Portfolios

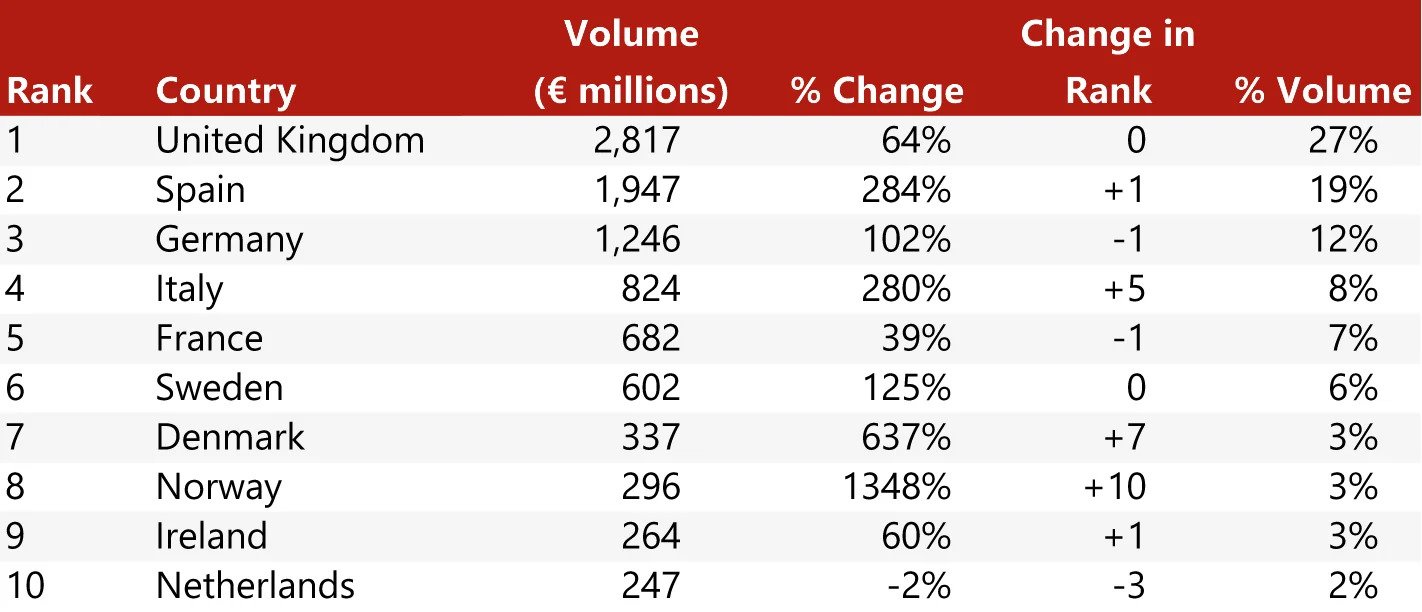

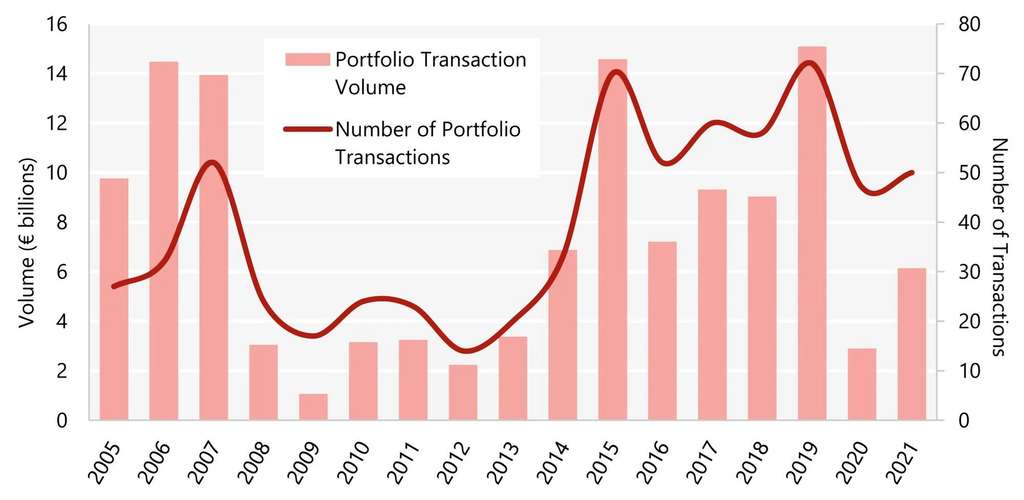

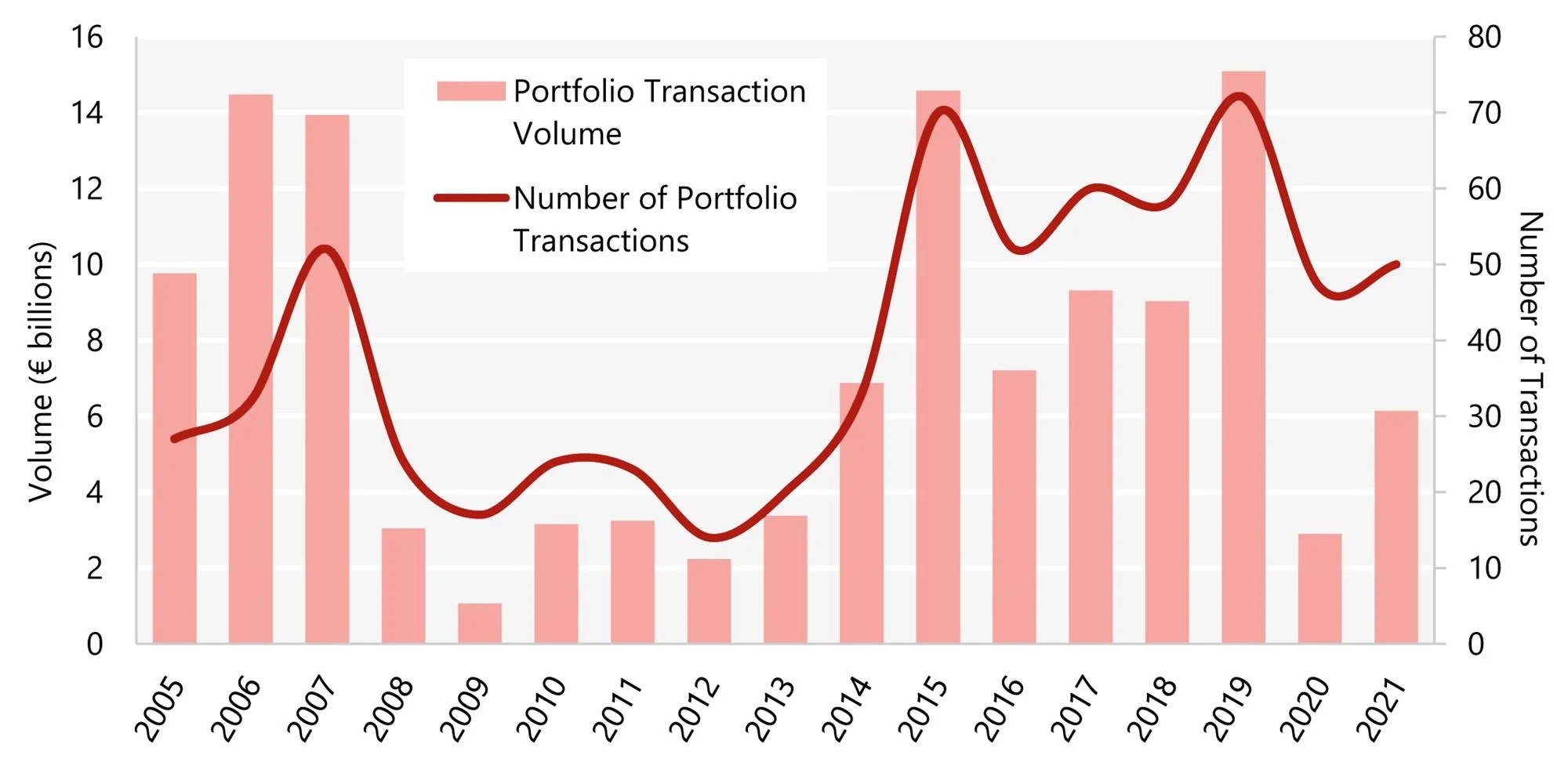

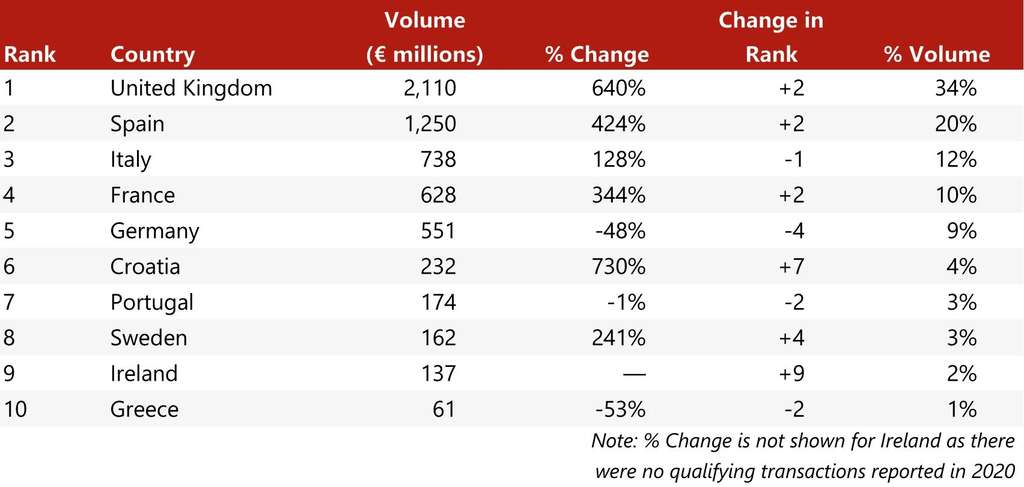

Portfolio transaction volumes in 2021 doubled compared to 2020, as shown in Chart 4. Compared to the previous market peak in 2019, however, volumes were still down by more than 50%, signalling that there is further recovery still to come. As shown in Chart 5, key drivers of volume were the UK and Spain, which collectively accounted for half of all portfolio transactions.

Chart 4: Portfolio Investment Volumes 2005-21

Pricing on a per room basis was generally flat compared to 2020, showing only marginal growth. Despite this, portfolios overall were more expensive than 2020, as transactions tended to include more hotels per portfolio and more rooms per hotel, resulting in noticeably larger deal sizes. Some markets, such as Sweden, Portugal, Spain and Germany, saw increases in average price per room compared to 2020, but other key markets, namely the UK, saw significant declines in pricing. Transaction activity was generally highest during the second half of the year, spiking in June and July, which collectively accounted for more than 40% of all portfolio activity. Europe and North America collectively accounted for 95% of all portfolio acquisitions, with key markets such as Asia and the Middle East remaining largely inactive, as was also the case in 2020. Overall, 2021 was a strong bounce back, with nominally higher prices, more deal activity, and more assets per deal, though portfolio transaction volumes were still 60% below that of 2019 and more than 30% down compared to 2018.

Chart 5: Portfolio Transaction Volumes by Country 2021

Volume

- Portfolio asset investment volume in Europe doubled to €6.1 billion in 2021; an increase of 112% compared to 2020. Despite the significant increase in volume, portfolio activity was far off of the pre-pandemic 2019 peak of €15 billion;

- Volume was led by the UK (€2.1 billion) and Spain (€1.3 billion), which collectively accounted for 55% of all portfolio transactions.

Pricing & Deal Size

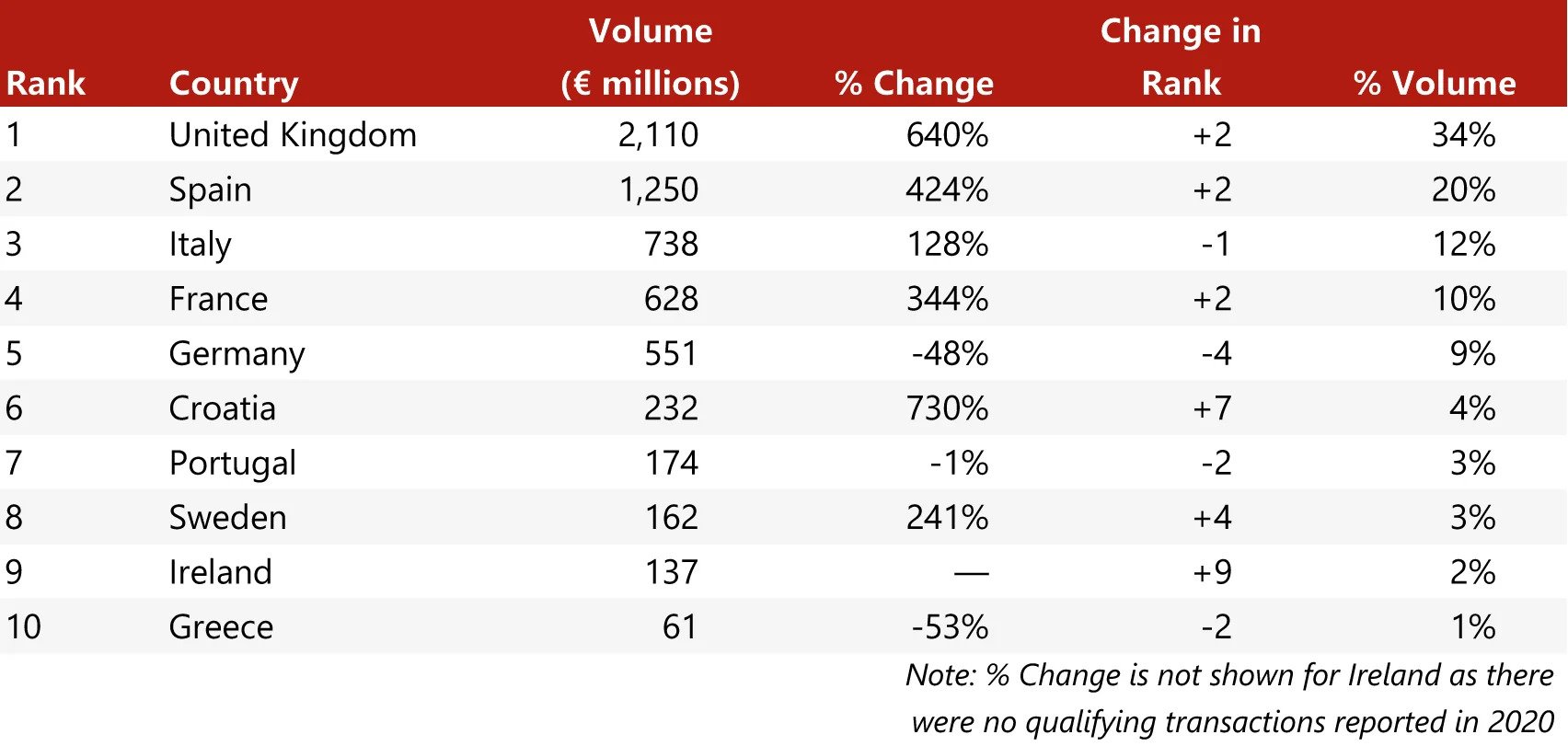

- As can be seen in Chart 6, portfolio sales averaged €154,000 per room, a minor increase of only 3% on 2020. Compared to 2019, the average price per room was €42,000 (-21%) cheaper in 2021;

- Portfolio volumes in 2021 were generally larger than 2020, characterised by having more hotels per portfolio and more rooms per hotel, resulting in the average price per portfolio being twice that of 2020;

- Standout markets for price per room increases compared to 2020 include Sweden (+85%), Portugal (+82%), Spain (+47%) and Germany (+20%).

Chart 6: Pricing and Deal Size

Capital by Continent

- 79% of portfolio acquisitions were undertaken by European investors, followed by 16% from North America;

- Asian and Middle Eastern buyers were noticeably inactive in terms of portfolio acquisitions in 2021, accounting for less than 5% of the overall activity;

- Asian and European companies were net sellers for the year, while North American investors acquired €500 million more than they sold.

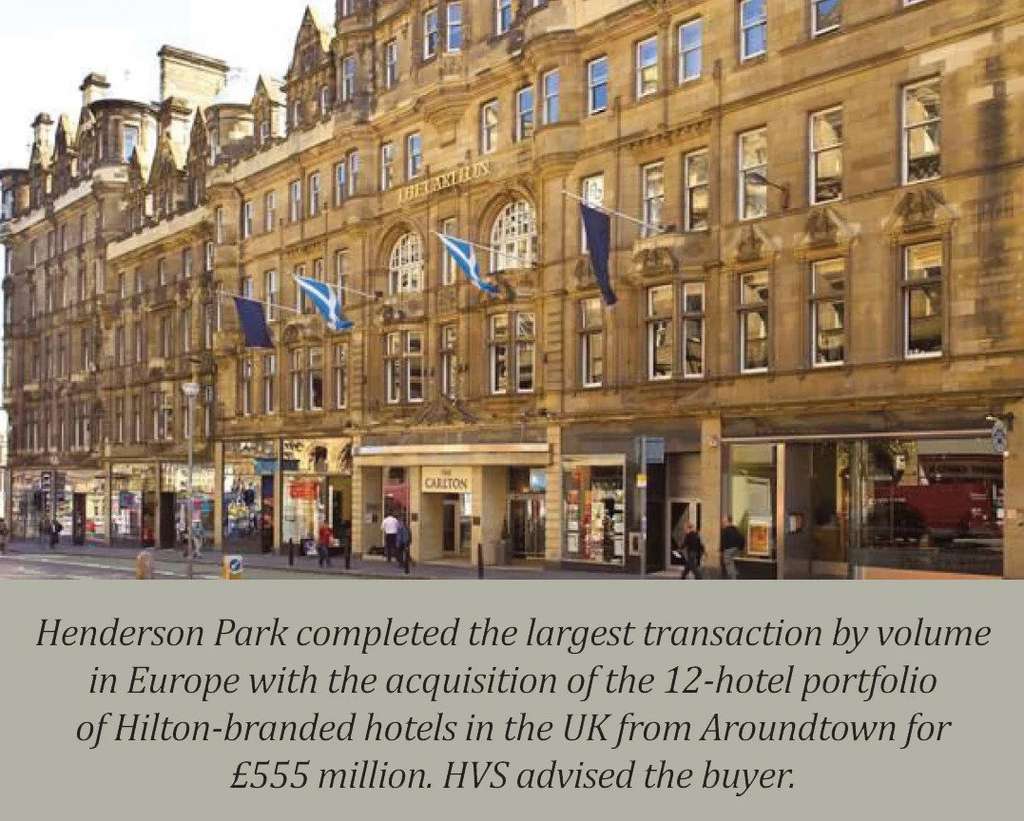

Notable Portfolio Transactions

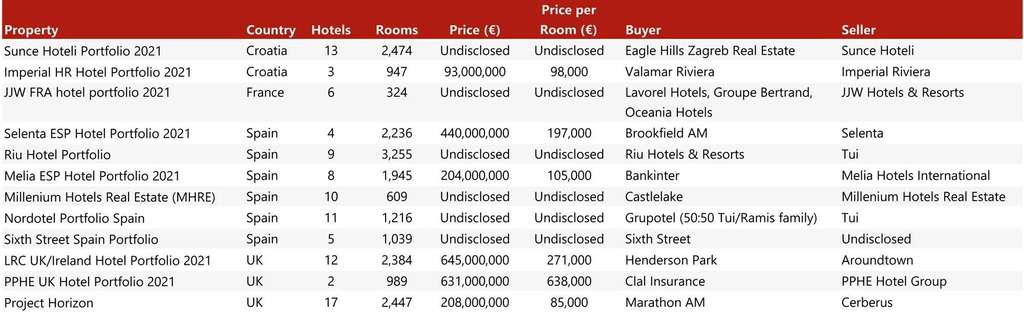

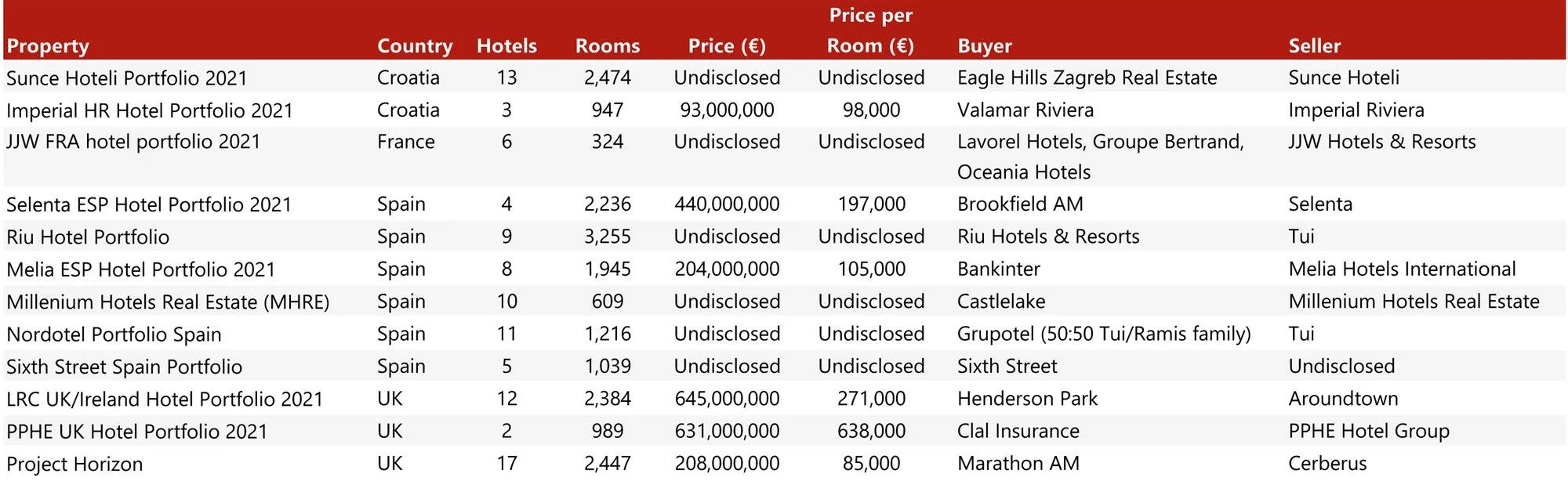

Presented in Chart 7 are a selection of portfolio transactions that occurred over the course of 2021. To access the full list of transactions, please contact [email protected].

Chart 7: Notable European Portfolio Transactions in 2021

Total Transaction Volume

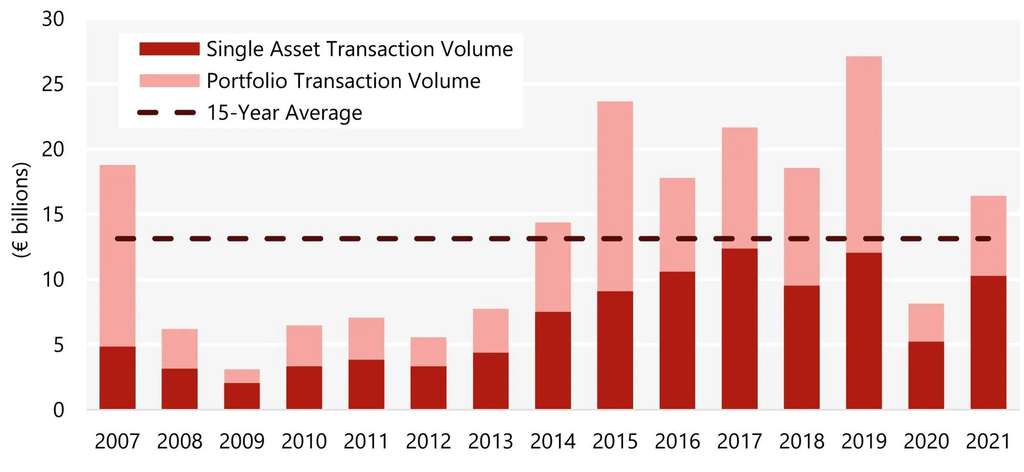

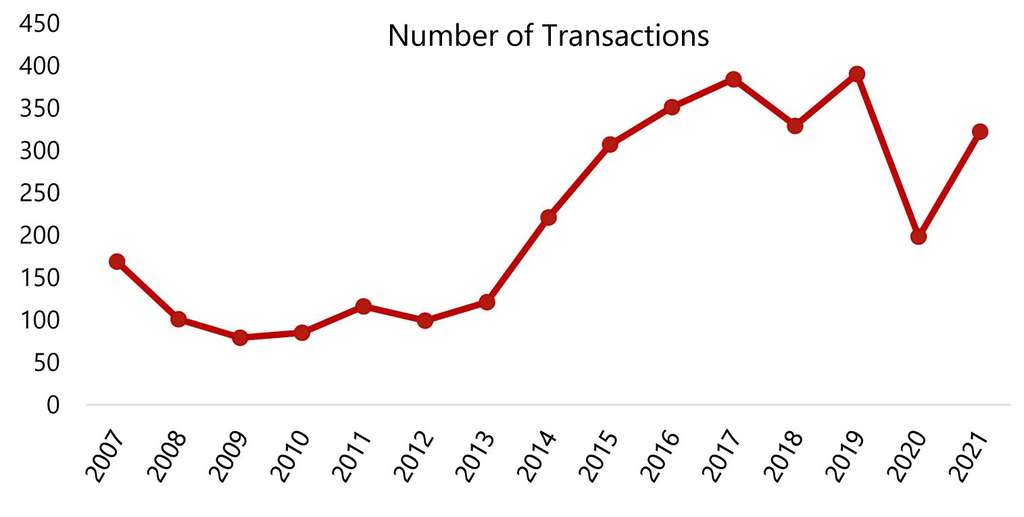

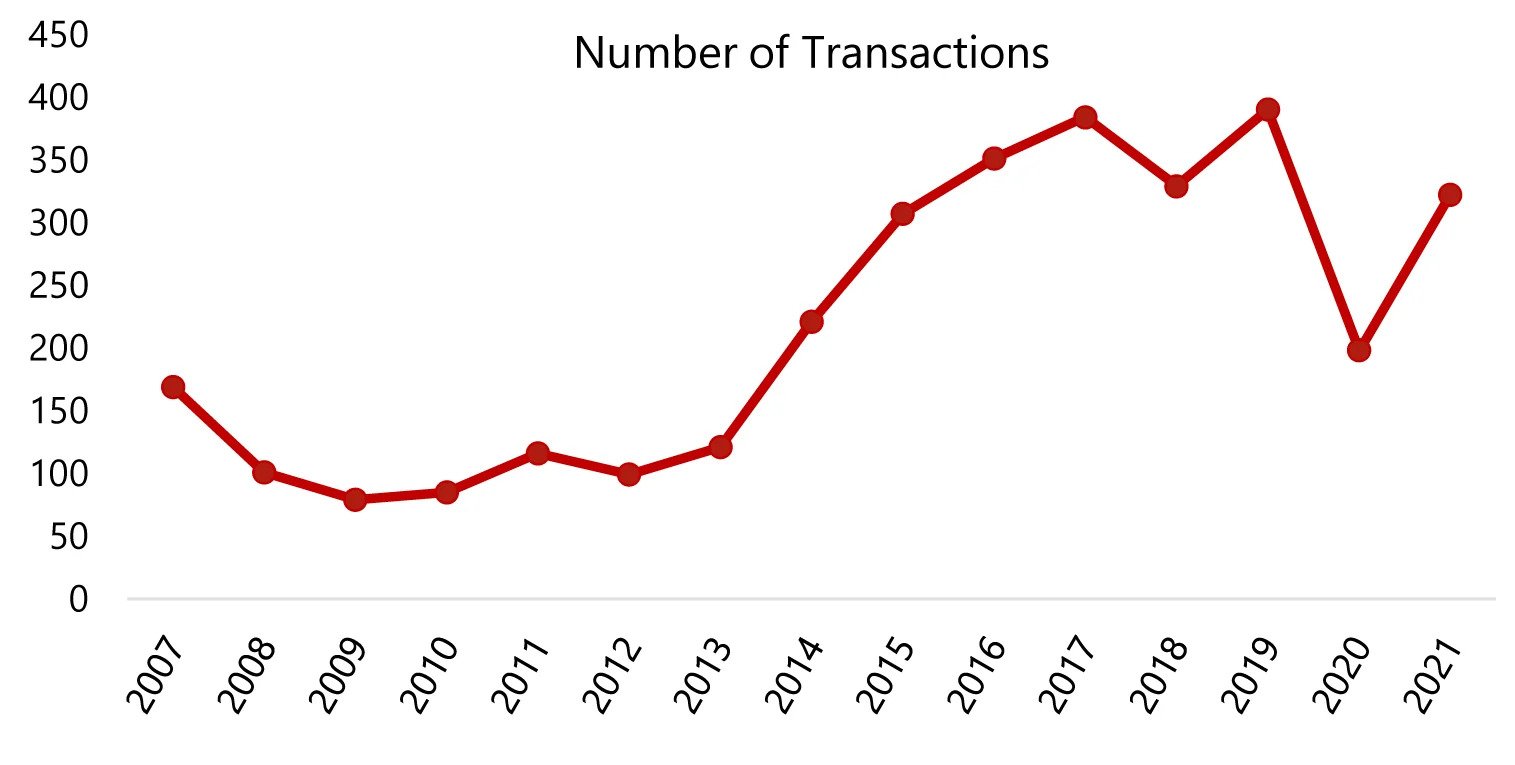

- Hotel investment volume, shown in Chart 8, doubled in 2021 to €16.4 billion (+102%) compared to 2020, signalling a significant recovery of the market;

- Volume in 2021 was down 39% compared to 2019; however, the recovery from COVID 19 is highly accelerated when compared to the Global Financial Crisis. In fact, transaction volumes did not return to 2007 levels until 2015, eight years after this crisis;

- 65% of transactions by monetary volume were single assets, while 35% were portfolios. This 2:1 ratio is identical to the one seen in 2020, but over the long term, the average is closer to 1:1.

Chart 8: Total Hotel Investment Volume 2007-21

Key Areas of Activity

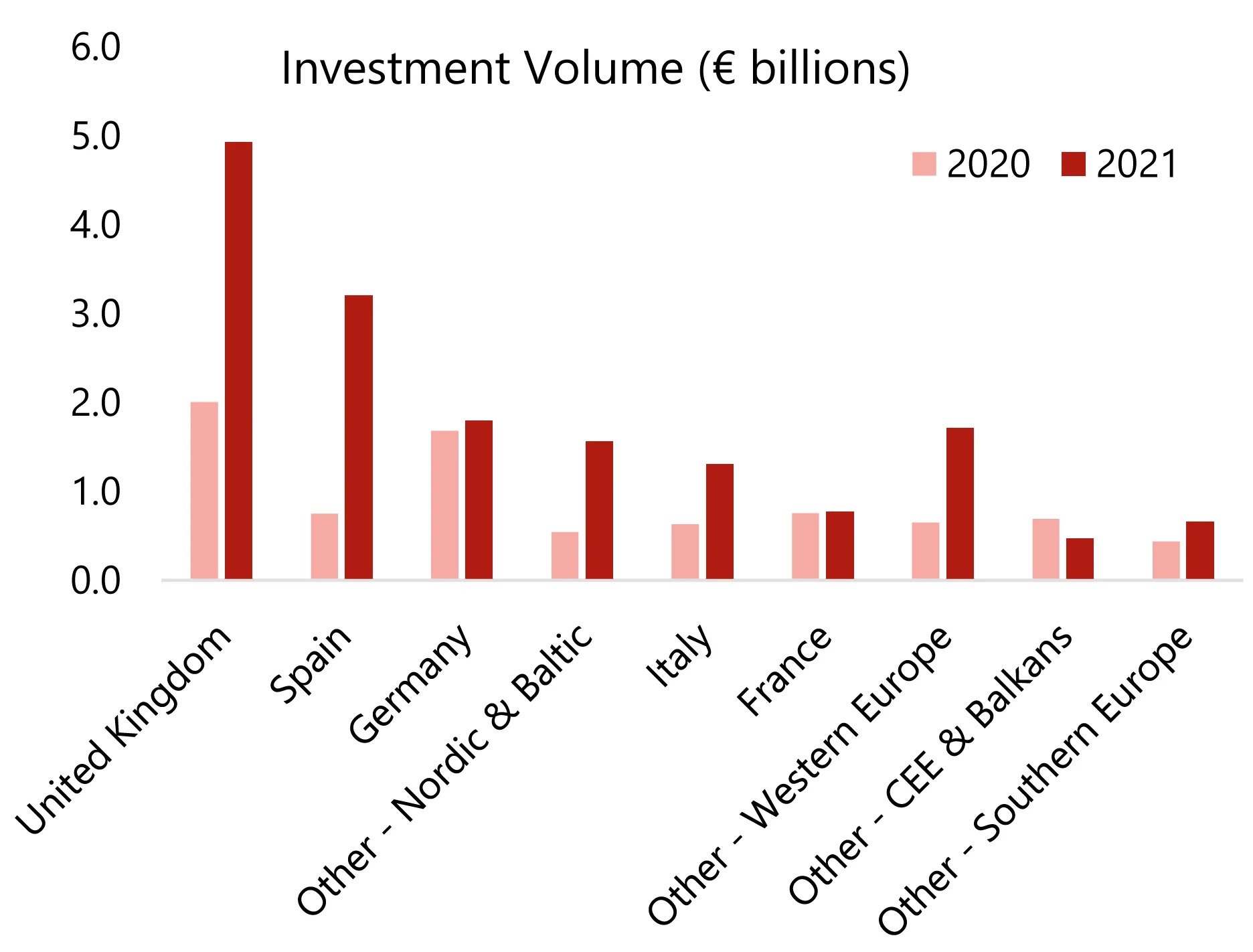

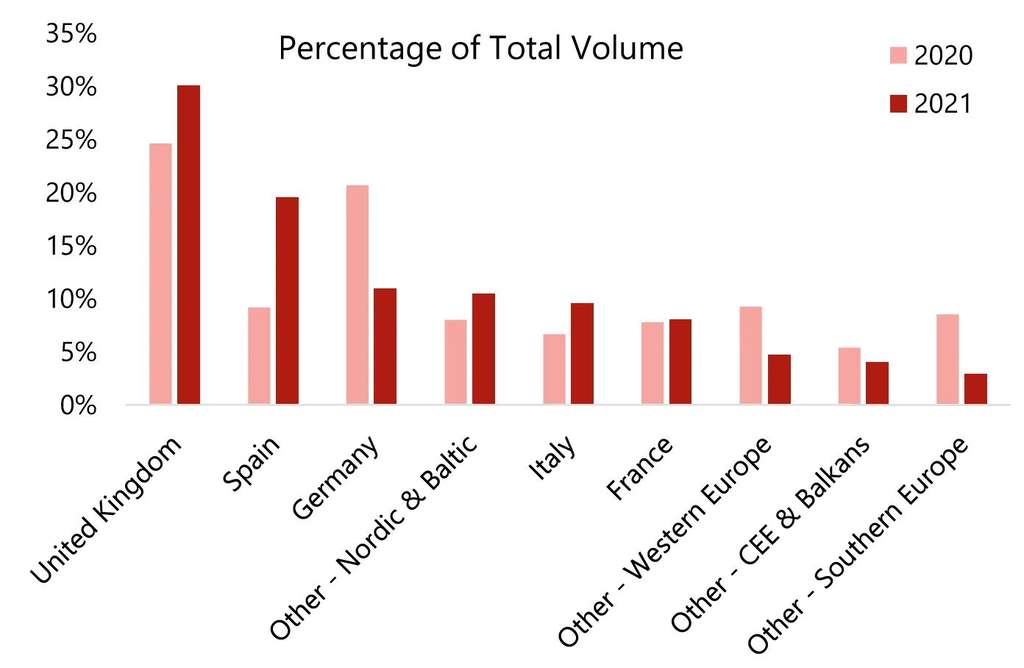

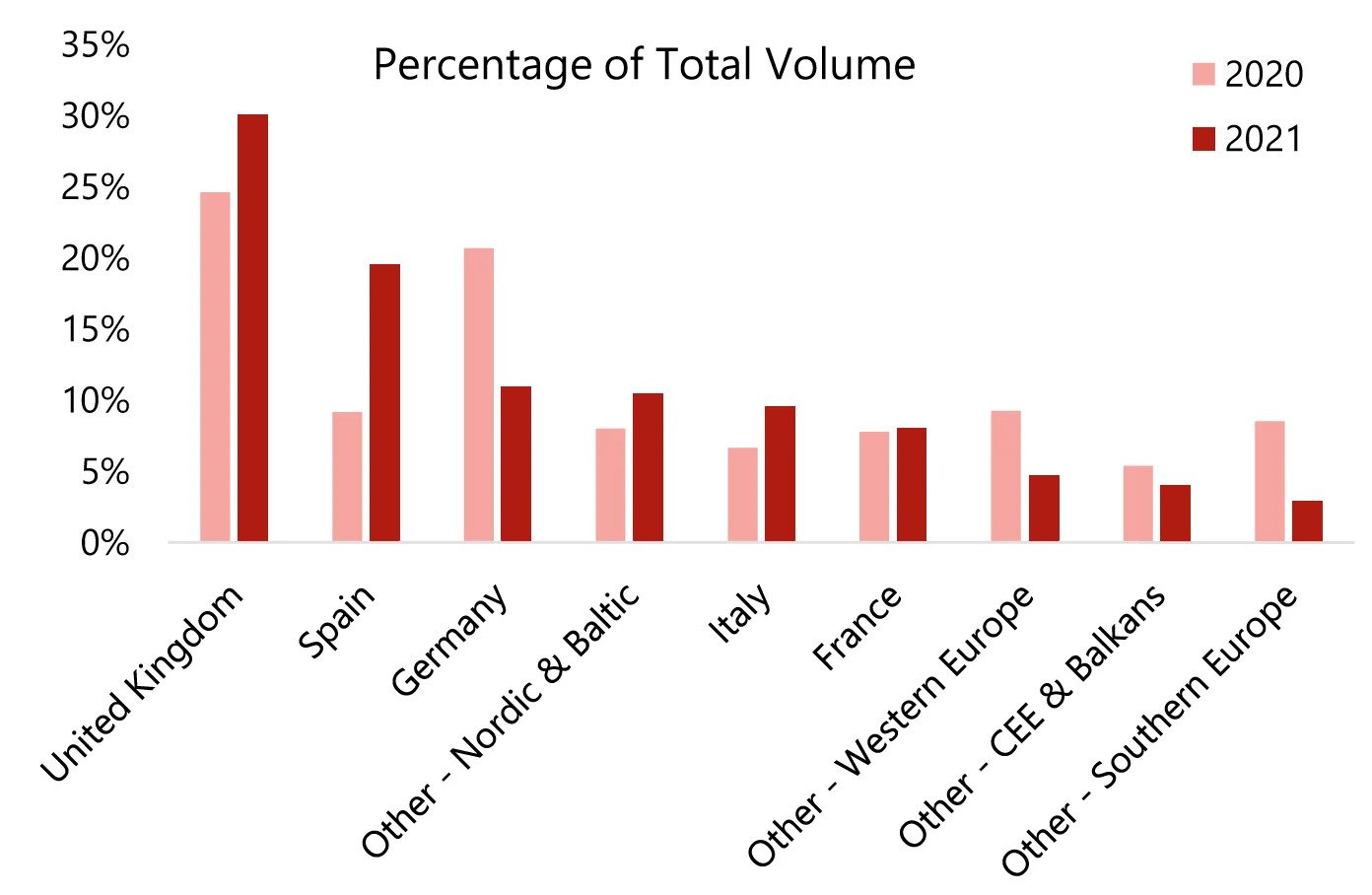

- As can be seen in Charts 9 and 10, the UK saw the largest volume of transactions, at €4.9 billion, an increase of 146% compared to 2020, representing 30% of the overall volume for the year. London volume accounted for 53% of total UK transactions;

- Spain, another very active market for HVS, saw €3.2 billion in transactions, overtaking Germany as the second-highest volume for the year at 19% of the overall volume. With 24% of the total Spanish transactions volume, Barcelona was Spain’s most active market, ahead of Madrid (15%);

- Key cities with high activity include London (€2.6 billion), Barcelona (€770 million), Stockholm (€600 million), Berlin (€540 million), Madrid (€465 million) and Paris (€414 million). Collectively, these cities accounted for 32% of the total transaction volume, a similar proportion to 2020.

Chart 9: Total Investment Volume by Country in 2020 and 2021

Chart 10: Percentage of Total Investment Volume by Country in 2020 and 2021

Pricing & Deal Size

- The average price per hotel in 2021 was €32.9 million, representing a 15% increase over 2020 and a 3% increase over 2019;

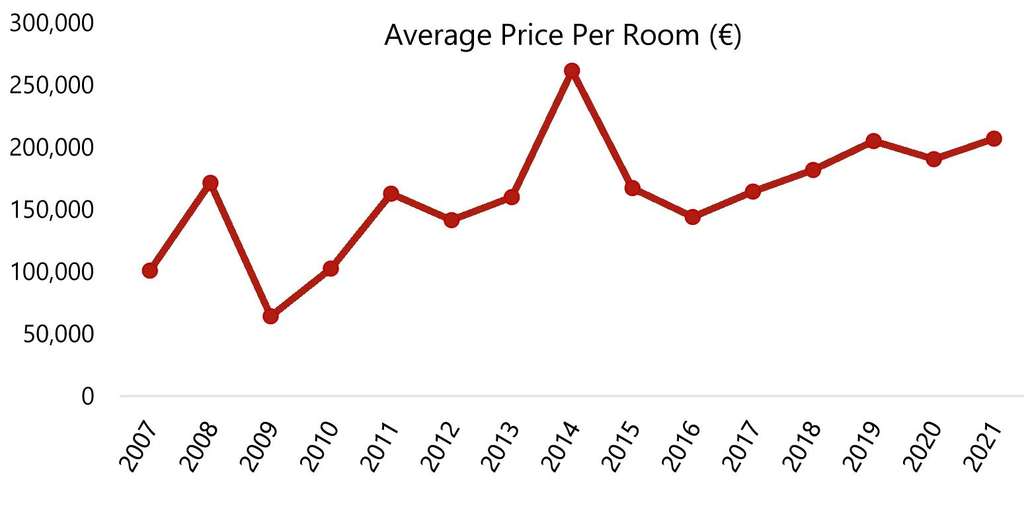

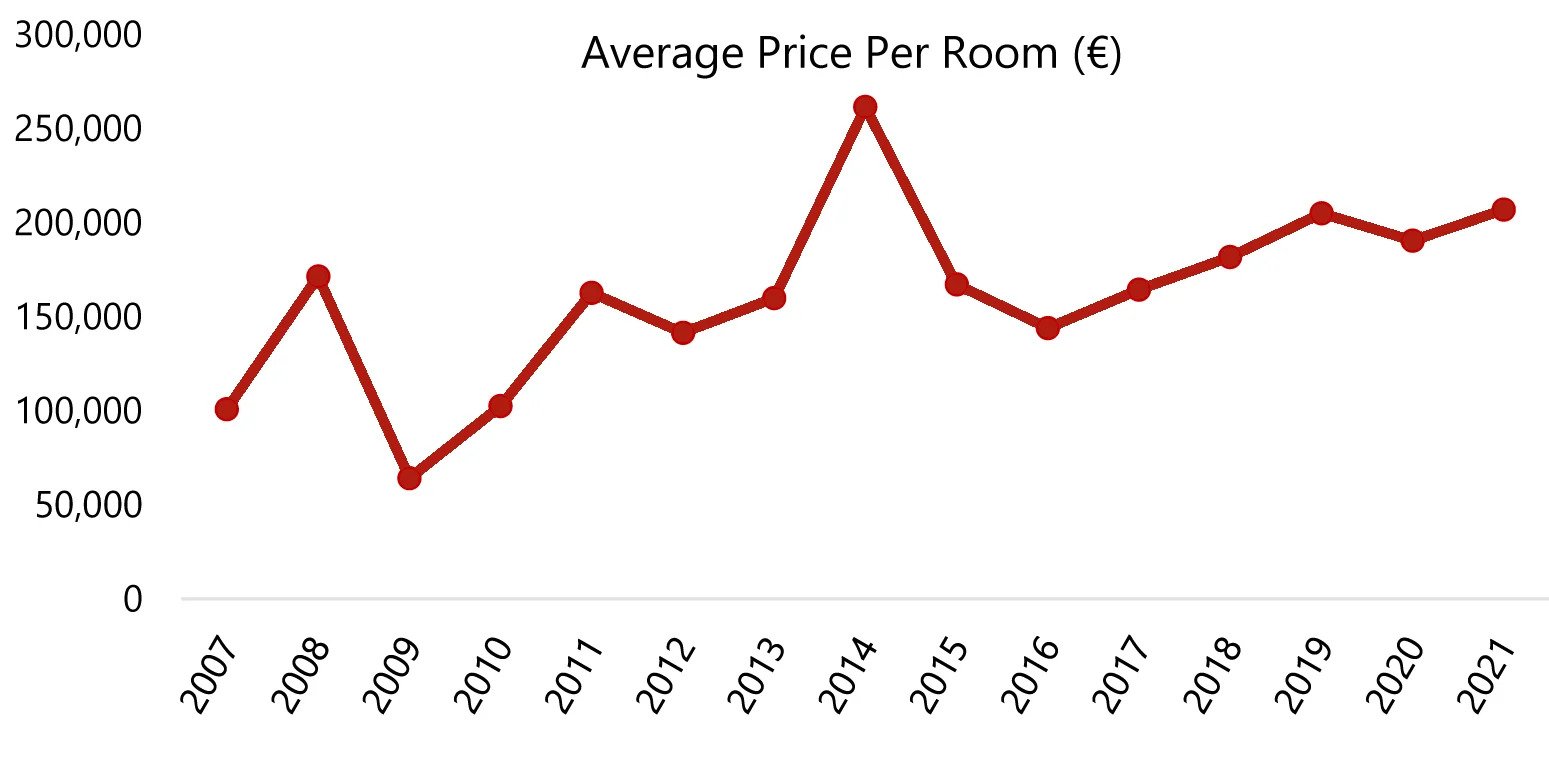

- As shown in Chart 12, the average price per room was €207,000 in 2021, representing a 9% increase over 2020 and a 1% increase on 2019. This is the highest price per room recorded since 2014;

- A total of 322 transactions took place in 2021, more than 50% more than in 2020, but 17% less than in 2019;

- Hotels that transacted in 2021 had an average of 159 rooms, which is slightly higher than 2020 (+6%) and 2019 (+2%).

Chart 11: Total Transactions 2007-21

Chart 12: Average Price per Room 2007-21

Activity by Investor Type

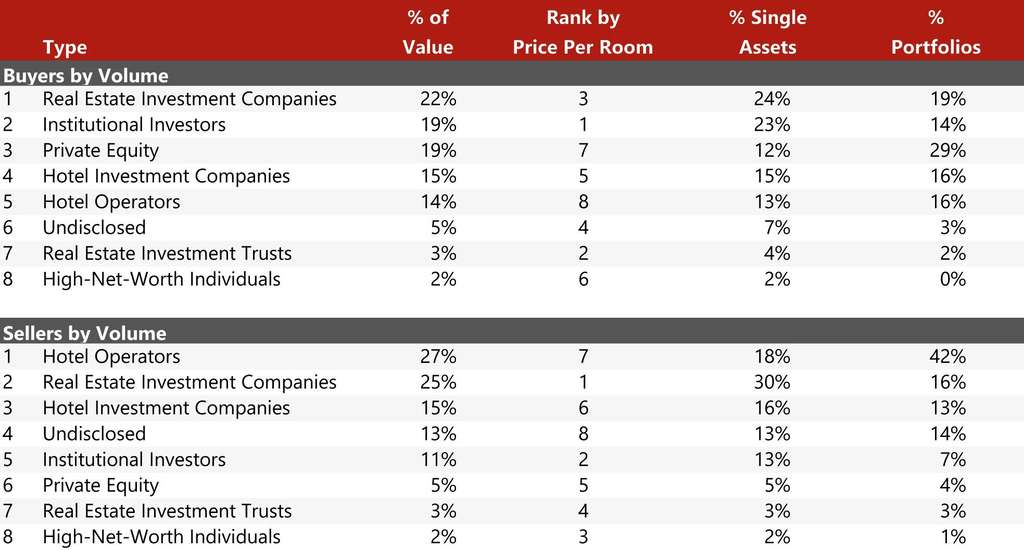

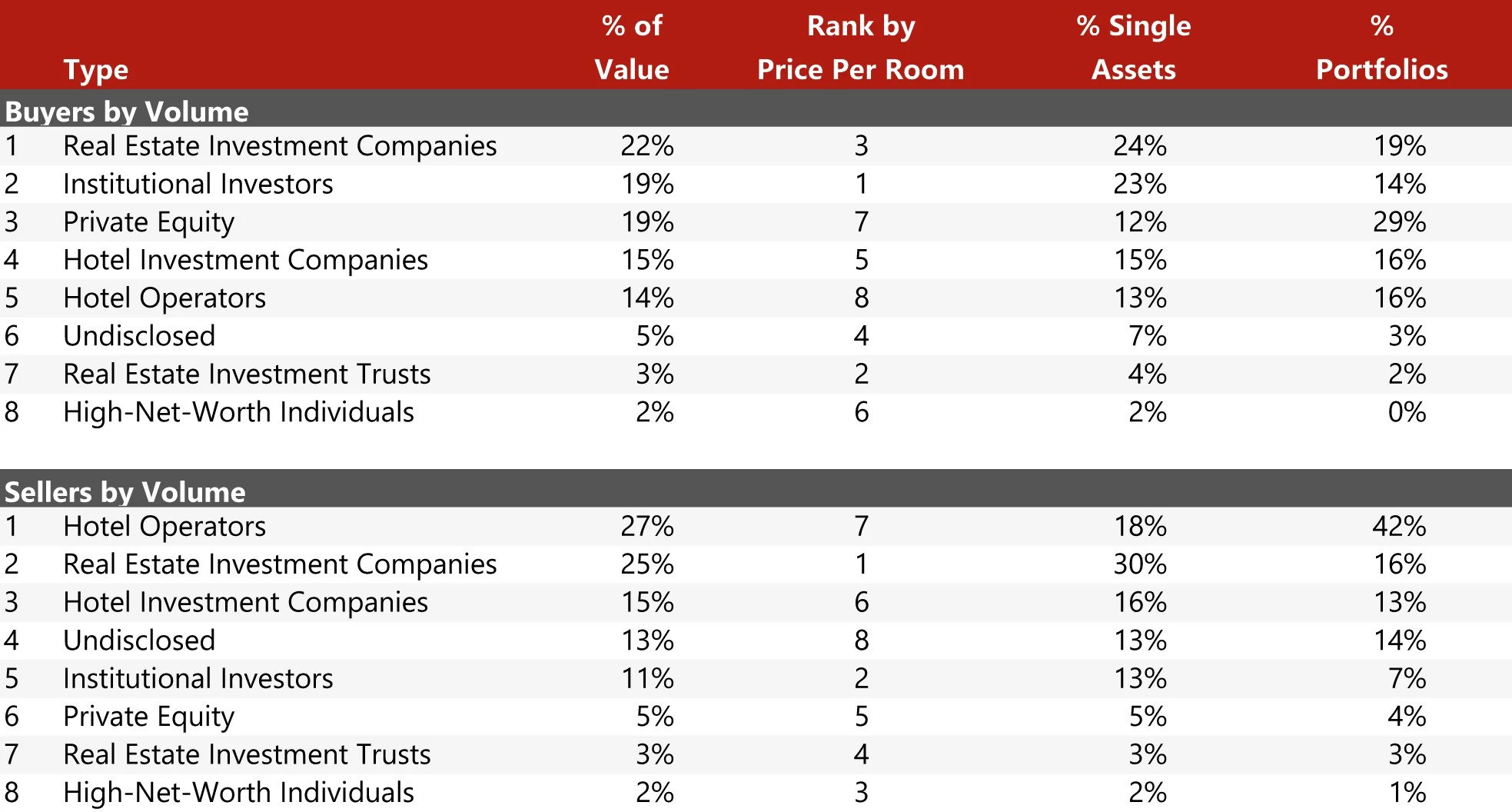

- Chart 13 shows acquisition activity was generally distributed evenly across investor types, with all but High-Net-Worth Individuals and REITs being highly active;

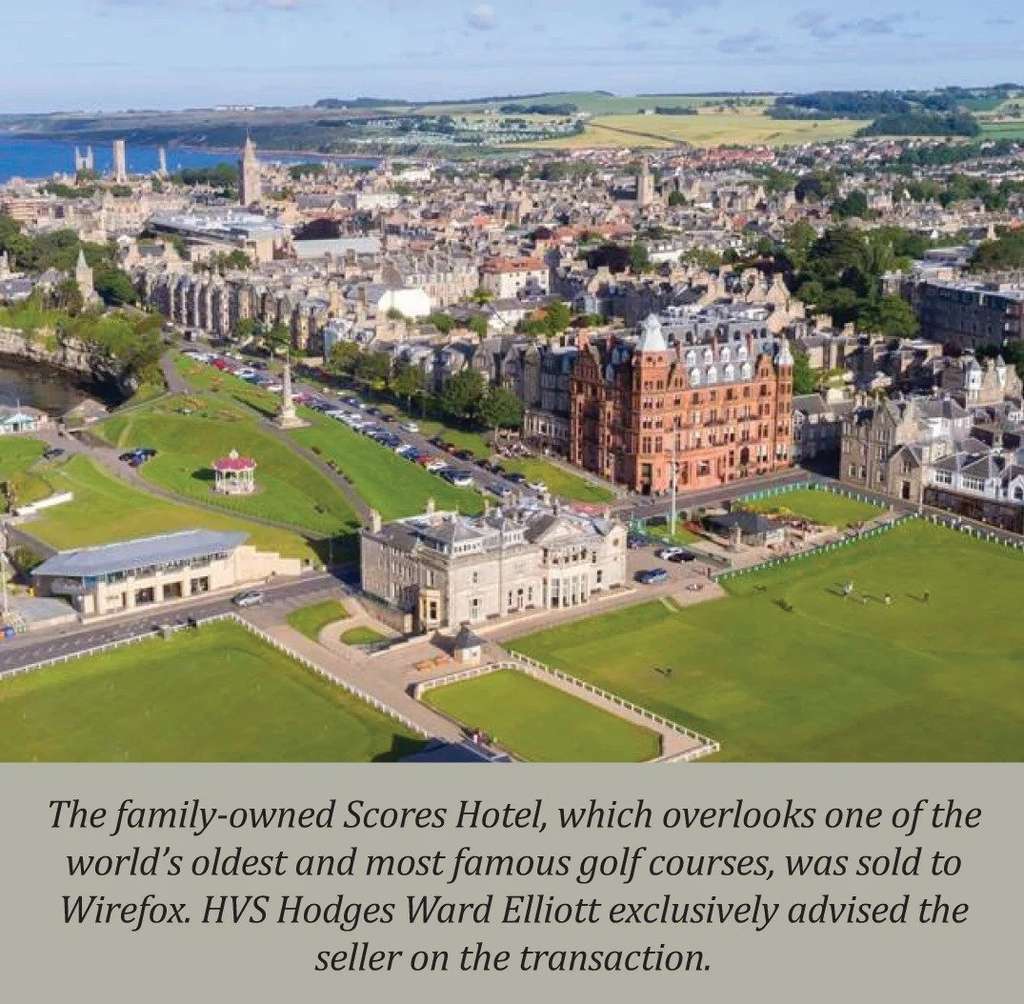

- Hotel Operators, such as TUI, and Real Estate Investment Companies were the largest sellers. HVS Hodges Ward Elliott acted as exclusive advisor to TUI on the sale of both the Toscana Resort Castelfalfi in Italy and Hotel Lena Mary in Spain;

- Private Equity and Institutional Investors were the largest net buyers, collectively acquiring more than €3.8 billion more than they sold. The largest net sellers were Hotel Operators, with €2.3 billion in net disposals.

Chart 13: Buyer and Seller Transaction Volumes by Investor Type 2021

Capital by Continent

- European investors represented the overwhelming majority of acquisitions and disposals, collectively accounting for 73% of all transactions;

- North America was the second most active, accounting for 11%;

- Asian investors were more active in 2021 than in 2020;

- Middle Eastern investors were largely inactive compared to 2020.

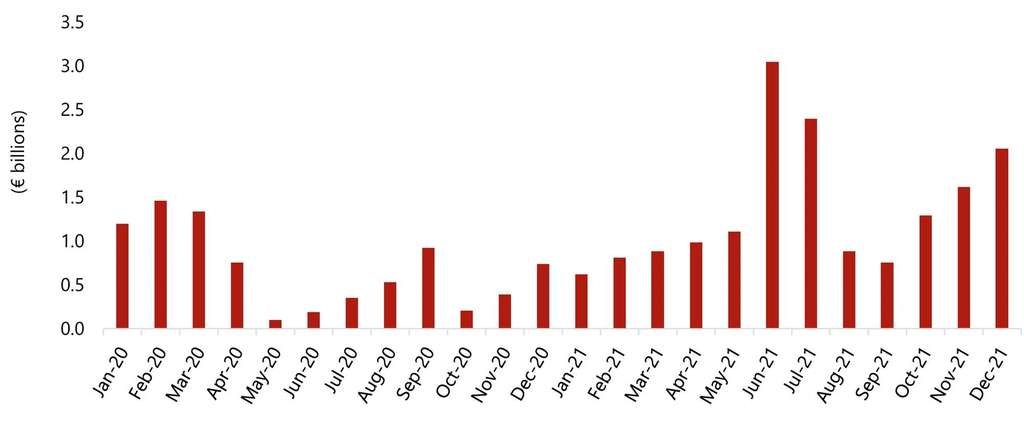

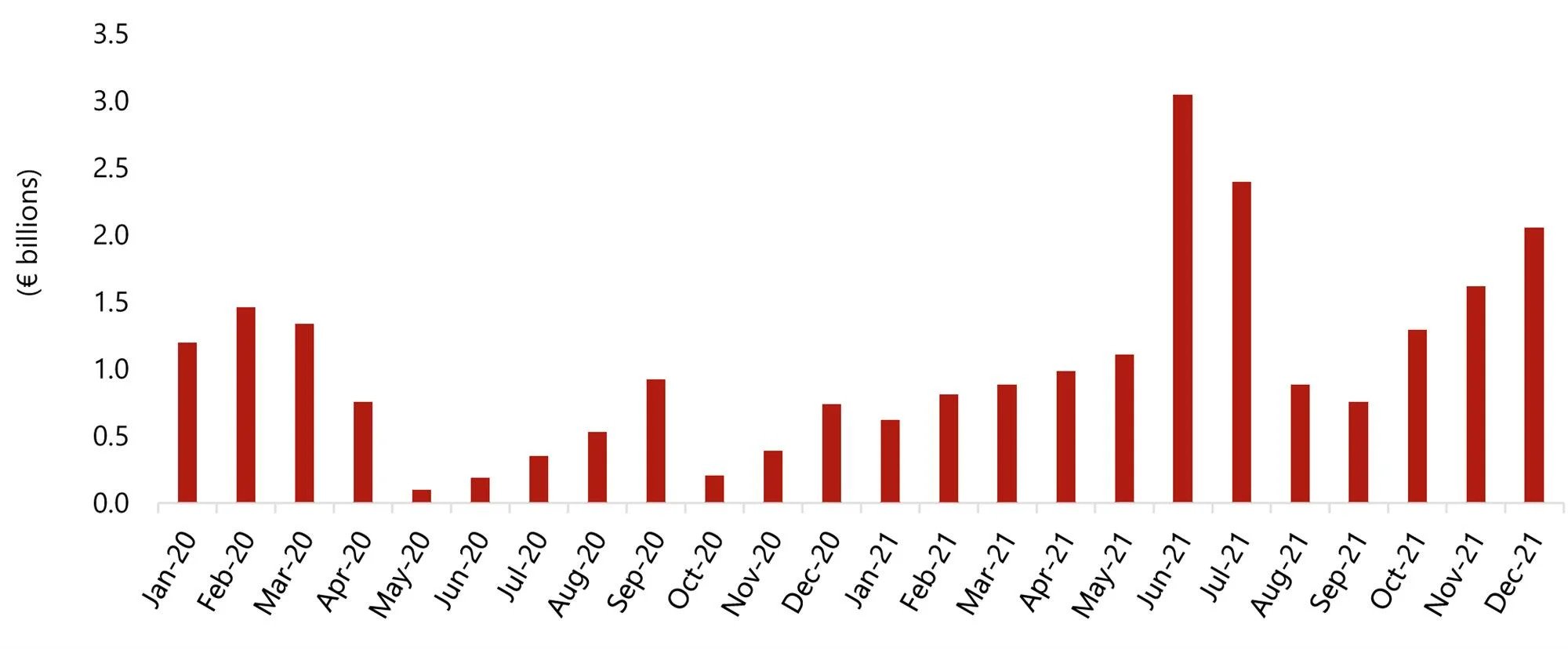

Seasonality

- As shown in Chart 14, deal volume was strongest in the summer months, as well as the end of the year, as investors pushed deals over the line before the end of the summer and before the calendar year end (with deal makers potentially keeping an eye on their annual bonuses‽);

- Generally, deal activity was higher in months with reduced lockdown restrictions.

Chart 14: Deal Volume Seasonality in 2020 and 2021

Conclusion and Outlook

2021 yielded a strong recovery in terms of total transaction volume, doubling that of 2020. Single-asset transaction volumes nearly reached that of 2019, though portfolio transactions lagged behind. The year set record pricing for single assets, and the average price per room for portfolio transactions also increased compared to 2020. The balance between portfolios and single assets was noticeably skewed towards single assets, as investors deployed powder kept dry during 2020 in search of prime opportunities, but fell short on financing options for larger, more capital-intensive portfolio deals. The most active net buyers were Private Equity and Institutional Investors, whose weight of capital mandated that deals be done. While the UK, with London at its helm, retained the top spot as the hottest market in Europe, Spain saw significantly more investment activity, bolstered by strong activity in Barcelona and Madrid. The Nordics also saw high levels of single-asset activity, achieving demonstrably higher prices per room.

The Hilton Edinburgh

Looking forward, single-asset transaction activity is expected to remain strong, as investors hunt for opportunities now that pandemic restrictions have largely subsided. Provided that a truce can be agreed to end the war in Ukraine in a timely manner, reductions in loan delinquency and changing lending sentiment should allow for increased portfolio activity in 2023 and 2024, lifting the overall transaction volume. Investors that have stayed out of the buying process looking for quick deals or significant discounts are likely to be met with internal pressure, as distressed opportunities become scarcer, making it less favourable to hold on to capital with a ‘wait-and-see’ strategy.

In terms of pricing, inflationary pressure, brought on by significant governmental stimulus packages globally, is likely to be felt. Furthermore, tourism and conferencing indicators are trending upward, which will likely assist in driving top-line hotel revenues. While the impact of the work-from-home/hybrid model is still unfolding, there is little question that digitalisation trends have accelerated the velocity of business and led to more interactions between businesses. While digital meetings have become more of a norm, they have not replaced the need for personal contact. Businesses are endeavouring to meet face-to-face with new leads and contacts met digitally during the pandemic, often making multi-stop or multi-purpose trips, all of which will revitalise the need for business travel. Overall, these market forces should provide uplift for hotel revenues, thus making hotel investment a more attractive opportunity.

The Scores Hotel St. Andrews

One additional point worth mentioning is that the impact of Environmental, Social and Governance (ESG) and ‘green’ investing is still under scrutiny. While these factors have certainly taken the front seat in hospitality conversations, with buyers and lenders alike looking for green opportunities, the effect on transaction pricing and volume is yet to be seen. One potential driver of this trend could be stronger, industry-wide standardisation on what exactly constitutes an ESG-friendly hotel or company. Metrics for comparison are currently fragmented, with little transparency as to what the different certifications entail. Should a more unified approach come to fruition, bottom-up consumer preferences and top-down investment practices could shift acquisition practices in favour of ESG-compliant assets.

[1] Only transactions above €7.5 million are considered in this analysis.

View source

Recent Posts

- Comment: Cruise is part of the solution, not the problem

- Kudatuli PDIP Bisa Dialami Parpol Lain dalam Bentuk Berbeda

- Asia Pacific Hospitality Newsletter – Week Ending 19 July 2024

- NICE’s methodology means people with cancer aren’t getting drugs – AstraZeneca’s Sir Pascal Soriot said | Business News

- Luton promises quicker security checks with new scanners

Recent Comments