European Hospitality Sector – Operators’ Perspective

Nearly two and half years after the Covid-19 outbreak erupted, operators are optimistic about the recovery of the hospitality sector and keen to expand across Europe. Nevertheless, they are also facing challenges with their existing pipeline while adjusting to the new normal via evolving their operating structures and contractual terms.

Cushman & Wakefield presents the findings of surveys conducted among over 180 senior executives of leading hotel operators active in Europe. The surveys were carried out from H2 2021 to Q1 2022 across nine different markets: the Iberian Peninsula, UK & Ireland, France, Benelux, Italy, DACH, CEE, SEE, and Turkey.

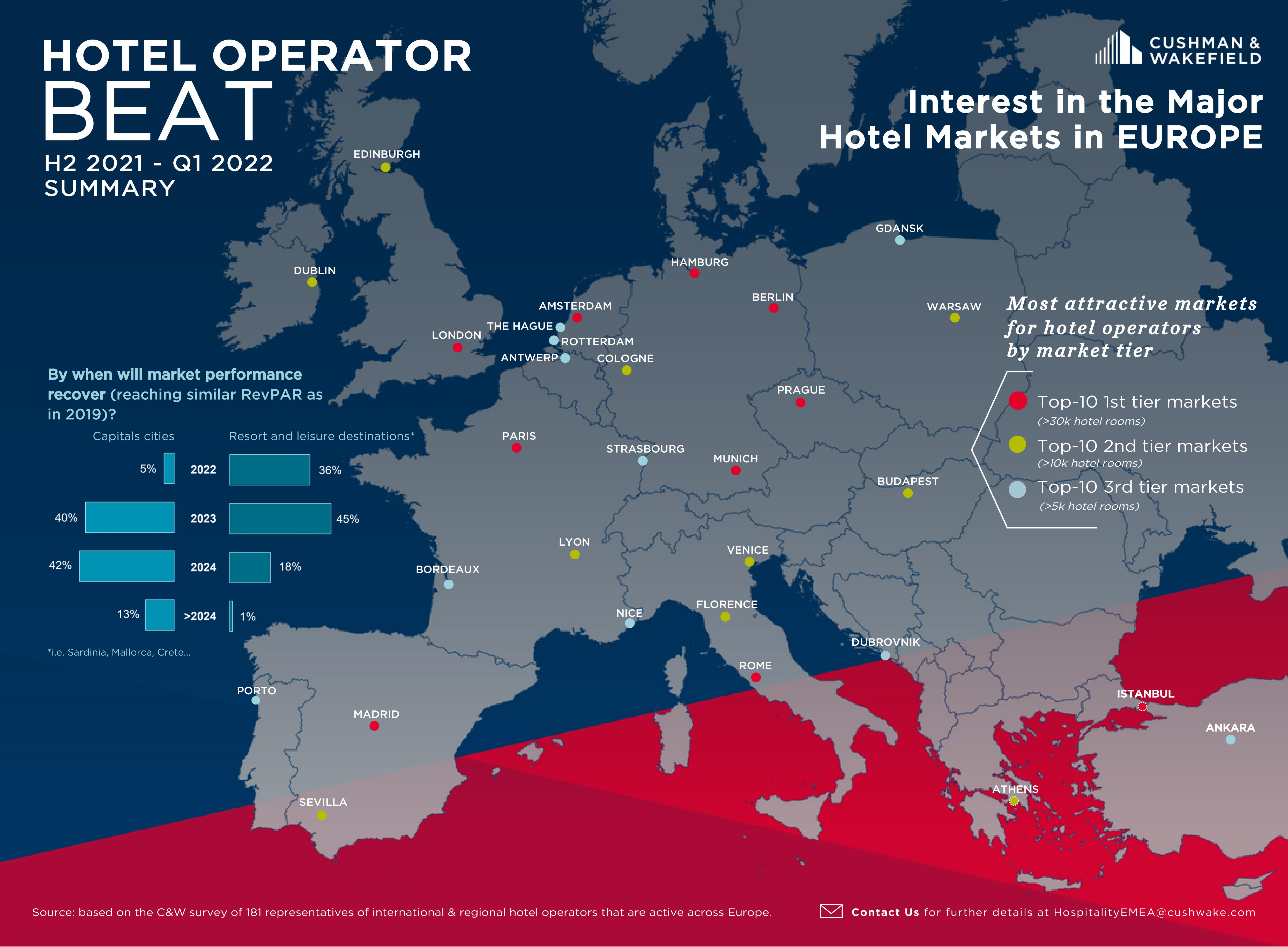

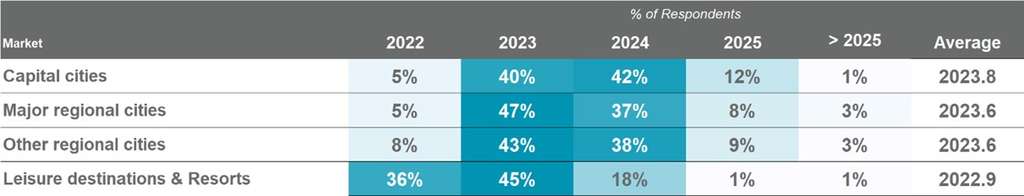

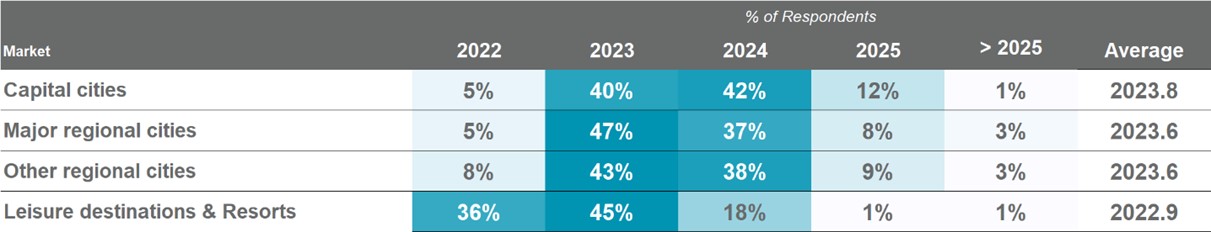

Major urban getaways remain as the go-to markets

Paris, London, Rome… it’s no surprise Europe’s bustling capitals are once again among the most sought-after destinations for hotel operators who expect them and other getaway cities to fully recover by 2024 (according to 87% of respondents). Notwithstanding, some interesting trends come to light when examining the results in more detail. In particular, Nice, Porto, and Dubrovnik are among the Top-10 third-tier markets, underpinned by their leisure appeal and operators’ expectation of faster recovery in these markets. According to our survey, 81% of respondents are anticipating leisure destinations to bounce back quicker than others.

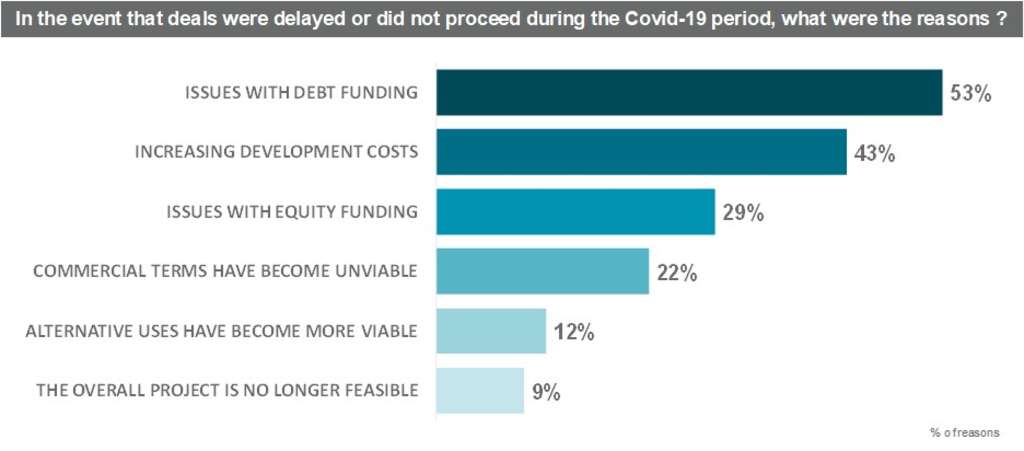

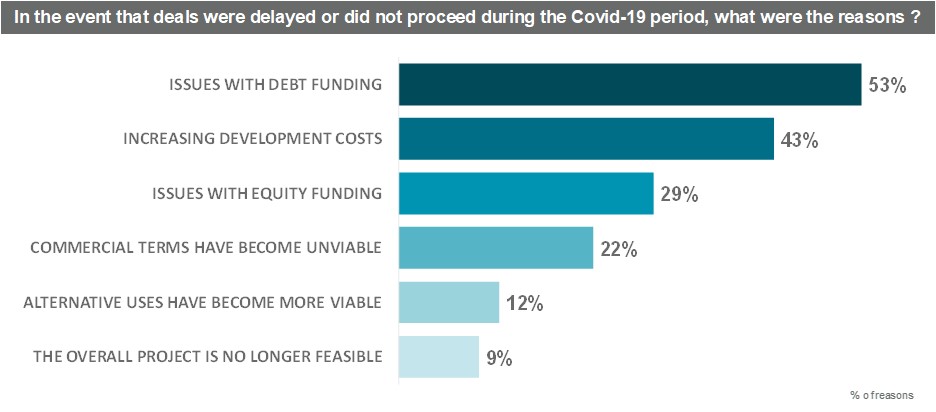

Cracks in the development pipeline

As a consequence of the COVID-19 pandemic, hotel operators across Europe are encountering some sort of delays in their projects, with the average range being 7-12 months. When breaking down the European market, operators in the Iberian Peninsula, operators are experiencing rather longer delays of 9-13 months, primarily driven by debt and equity funding issues. Another prominent cause for these delays was the increase in development costs, a phenomenon observed across most industries due to supply chain issues.

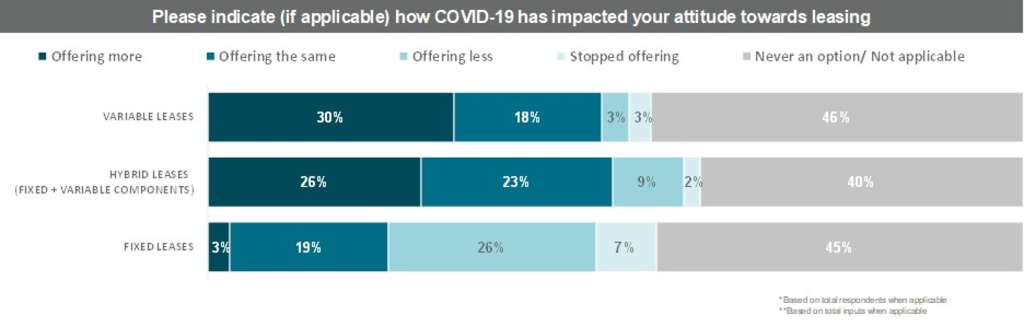

Evolution of leases towards more flexible structures

When it comes to lease contracts, operators are attempting to mitigate risk and are shifting towards hybrid and especially variable structures, offered more frequently by 30% of respondents. Overall, the survey confirmed a stronger presence of lease structures in the Iberian Peninsula, UK and Ireland, and Italy, while SEE and Turkey are more lenient towards management agreements.

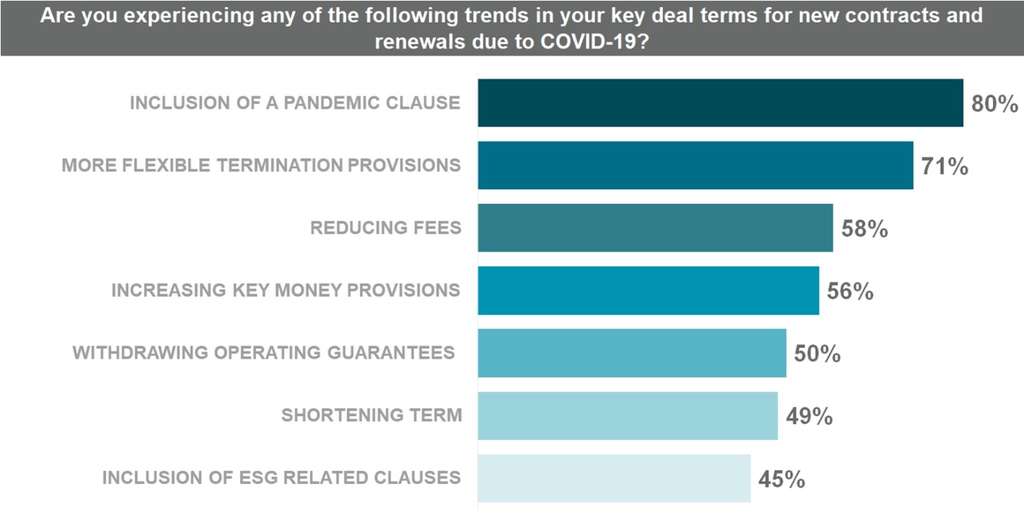

Risk-mitigation

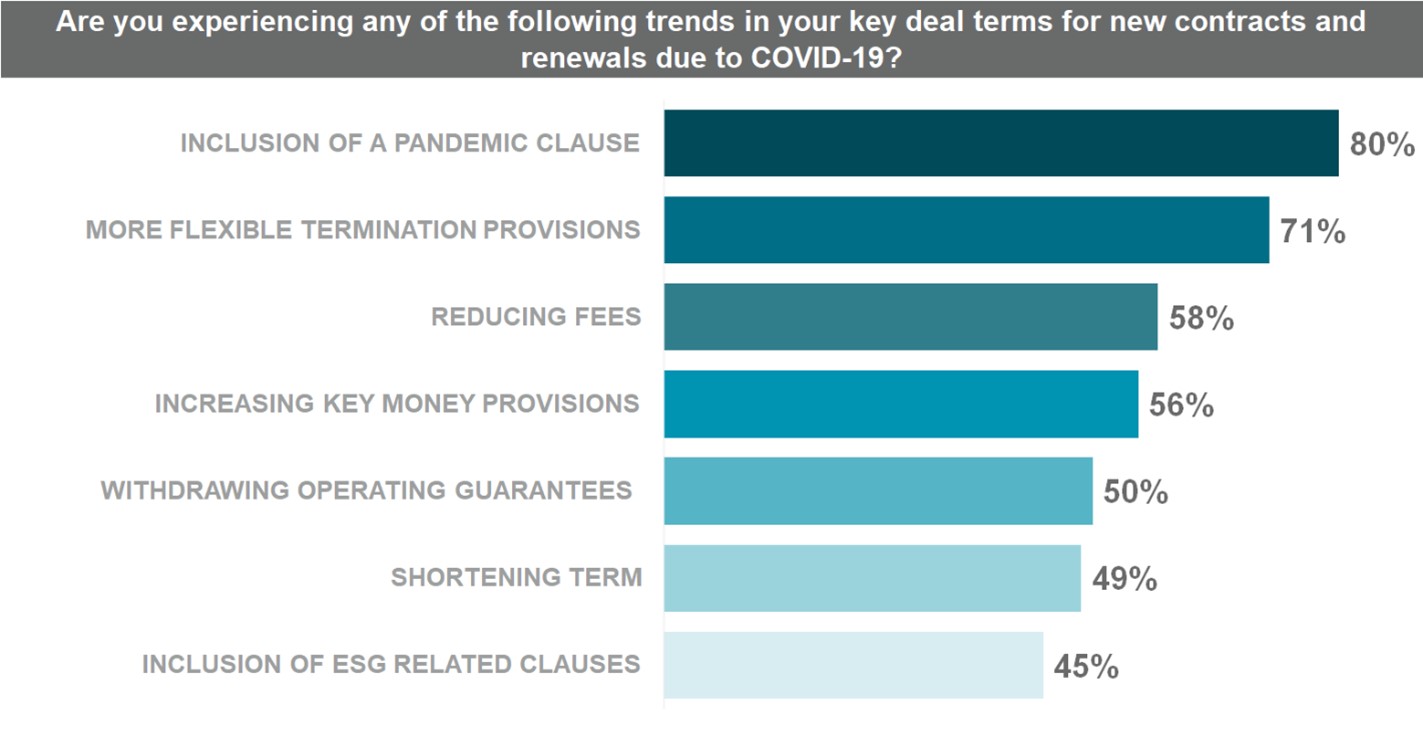

With the uncertainty brought on by the pandemic, many operators are introducing risk mitigation features in their new contracts and renewals such as withdrawal of operating guarantees and the inclusion of pandemic clauses, especially ubiquitous in Italy (reported by 93% of operators). These changes shift the risk towards to owners which is being compensated by higher key money, reduced fees, shortening term or more flexible termination provisions.

“It is clear to us, at C&W, that hotel operators are seeking to balance risk. However, the ability to fund hotel developments remains the critical determinate to whether hotels are built. Therefore, if mainstream leases evolve to a hybrid model, then investors must also evolve to accept the shifting risk. In our view fixed leases will remain the preferred model but certain owners/developers may consider alternative structures if the value proposition compensates for the additional risk.” Richard Candey – Partner, Head of Investor & Developer Services, EMEA at Cushman & Wakefield

ESG on the agenda

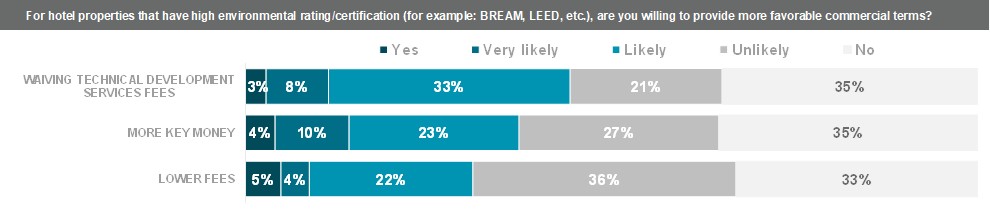

Although not in the top-3 trends when observing the overall European market, ESG clauses were more prevalent in France, Benelux, and the SEE, according to 67%, 64%, and 63% of respondents, respectively. The survey findings indicate a diverse approach among operators towards hotels with high sustainability credentials, with certain operators being willing to provide incentives to such properties. Among those offering or likely to provide better commercial terms, it is primarily through waiving technical development service fees (indicated by 44% of respondents) or by providing more key money (37% of respondents). Nevertheless, there is still lot of room for operators to offer owners support for ESG and their sustainable buildings.

“It’s promising to see hotel operators expressing their willingness to provide owners with some monetary support for ESG in their buildings. However, we are yet to see it in practice. It’s now our job as advisors to ensure that when we negotiate on behalf of owners, the investment in sustainability features is appropriately reflected in the commercial terms offered by operators. “ Borivoj Vokrinek, Partner – Strategic Advisory and Head of Hospitality Research, EMEA at Cushman & Wakefield

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 50,000 employees in over 400 offices and approximately 60 countries. In 2021, the firm had revenue of $9.4 billion across core services of property, facilities and project management, leasing, capital markets, and valuation and other services.

To learn more, visit www.cushmanwakefield.com or follow @CushWake on Twitter.

Recent Posts

- Elevate Your Ancillary Revenue with These 5 Proven Strategies

- The female gamers competing for thousands of pounds at first event of its kind in UK | Science & Tech News

- FAA, USDA using drones to prevent bird strikes

- Tragedi Tewasnya 7 Orang karena Kebakaran di Mampang, Jaksel

- Bank Mandiri Optimistis Likuiditas Tetap Terjaga

Recent Comments